Social Security 2025 Tax Limit. In 2025, that limit increases to $168,600. Individuals with multiple income sources.

Social security tax increase 2025. If you are an unmarried senior at least 65 years old and your gross income is more than $14,700.

Limit For Maximum Social Security Tax 2025 Financial Samurai, In 2025, the salary limit subject to social security tax is $160,200. But that limit is rising in 2025, which means seniors who are working and.

Learn About Social Security Limits, However, taxpayers who make less than $25,000 a year or ($32,000 for joint filers) can deduct all of their social security retirement income. For 2025, the social security tax limit is $168,600.

:max_bytes(150000):strip_icc()/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png)

Social Security Taxable Limit, An individual who attains the. The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2025 (an increase of $8,400).

States That Tax Social Security Benefits Tax Foundation, March 02, 2025 at 09:30 am est. You will need to file a return for the 2025 tax year:

Social Security Tax Limit 2025 Know Taxable Earnings, Increase, In 2025, the social security wage base limit rises to $168,600. As a result, if you're a high earner, you will pay more in.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons, If you are working, there is a limit on the amount of your earnings that is taxed by social security. In 2025, the limit was $160,200.

Social Security Taxable Calculator Top FAQs of Tax Oct2022, Social security tax increase 2025. Generally, each employer for whom you work during the tax year must withhold social security tax up to the annual limit.

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Social security (oasdi only) $ 160,200 $ 168,600 medicare (hi only) no limit. Generally, each employer for whom you work during the tax year must withhold social security tax up to the annual limit.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Social Security Benefits Raise 2025, Millionaires are set to hit that threshold in march and won't pay into the program for the rest of the. For 2025, the social security tax limit is $168,600.

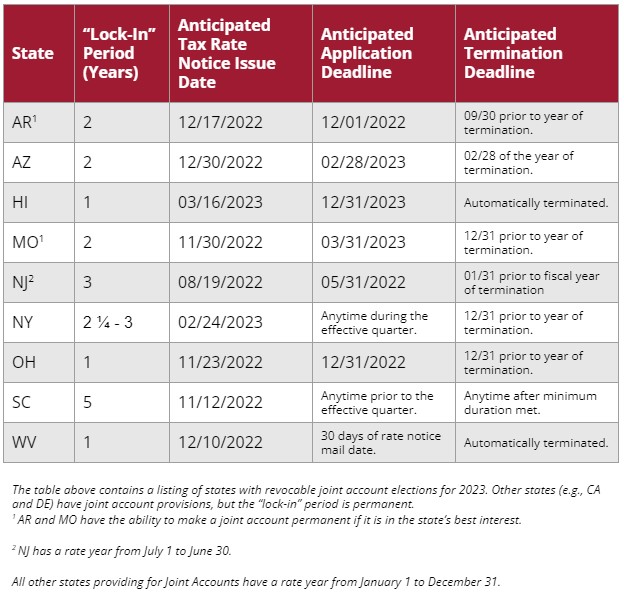

Strategies to Help Reduce SUI Tax Burdens in 2025 and Beyond, 23 2025 maximum taxable earnings. Update this update provides information about social security taxes, benefits, and costs for 2025.

If you are working, there is a limit on the amount of your earnings that is taxed by social security.

The social security wage cap will be increased from the 2025 limit of $160,200 to the new 2025 limit of $168,600.