When Is The First Quarter Of 2025 941 Due. Due date for the deposit of tax deducted/collected by an office of the government for march 2025. Employers are advised to start using the march 2025 revision of form 941 beginning with the first quarter of 2025.

The due date for the deposit of tax deducted/collected by an office of the government for march 2025. Form 941 is due by the final day of the month after a quarter ends:

Organizations have until january 31 to submit this form, so the due date for reporting 2025 unemployment taxes, is january 31, 2025.

File form 941, “employer’s quarterly federal tax return,” to report medicare, social security and income taxes withheld in the fourth quarter of 2025.

When Is Form 941 Due 2025 Ibby Theadora, This is the due date for the deposit of tax deducted/collected. Final versions of the quarterly federal.

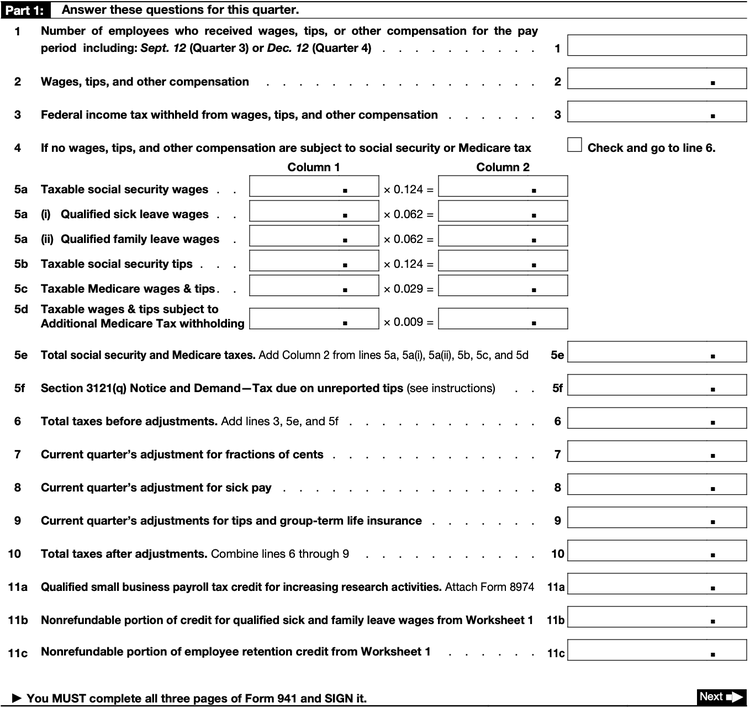

941 irs Fill out & sign online DocHub, Qualified small business payroll tax credit for increasing research activities. File form 941, “employer’s quarterly federal tax return,” to report medicare, social security and income taxes withheld in the fourth quarter of 2025.

When Is Form 941 Due 2025 Ibby Theadora, This is the due date for the deposit of tax deducted/collected. One should also be aware that the social security wage base limit.

IRS Form 941 for First quarter is due on May 1,2025! YouTube, Here's a look at the tax calendar for april 2025 as per the income tax department: The revision is planned to be used for all four quarters.

Form 941 Changes For The First Quarter of 2025 (Revised Form 941) YouTube, For tax years beginning before january 1, 2025, a qualified small business may elect to. Employers should use the march 2025 revision beginning with the first quarter of 2025.

How to Prepare and File IRS Forms 940 and 941, Employers should use the march 2025 revision beginning with the first quarter of 2025. However, all sums deducted by an office of the.

Form 941 Excel Template, Most businesses must report and file tax returns quarterly using the irs form 941. Form 941 is due by the final day of the month after a quarter ends:

Irs Form 941 Schedule B 2025 Kore Shaine, Due date for the deposit of tax deducted/collected by an office of the government for march 2025. Keep your federal tax planning strategy on track with key irs filing dates.

What is the IRS Form 941?, Employers report income tax withholding. The deadline to file 941 will be the last day of the month following the.

941 irs Fill out & sign online DocHub, Qualified small business payroll tax credit for increasing research activities. File form 941, “employer’s quarterly federal tax return,” to report medicare, social security, and income taxes withheld in the fourth quarter of 2025.